Rsi Elmex

- Experts

- Olesia Lukian

- Versão: 1.42

- Atualizado: 4 maio 2025

Introduction: The Science Behind RSI Trading

The Relative Strength Index (RSI) was developed by J. Welles Wilder in 1978 and has become one of the most trusted momentum oscillators in technical analysis. What began as a manual calculation method in Wilder's book "New Concepts in Technical Trading Systems" has evolved into an indispensable tool for traders across all markets. The RSI's power lies in its ability to quantify price momentum and identify potential reversal points through overbought and oversold conditions.

This Expert Advisor automates a classic RSI trading strategy, utilizing the time-tested principles that professional traders have relied on for decades. By systematically executing trades based on clear RSI signals, this EA removes emotional decision-making and enforces consistent trading discipline.

Strategy Overview

The Elmex RSI EA employs a straightforward yet effective approach:

-

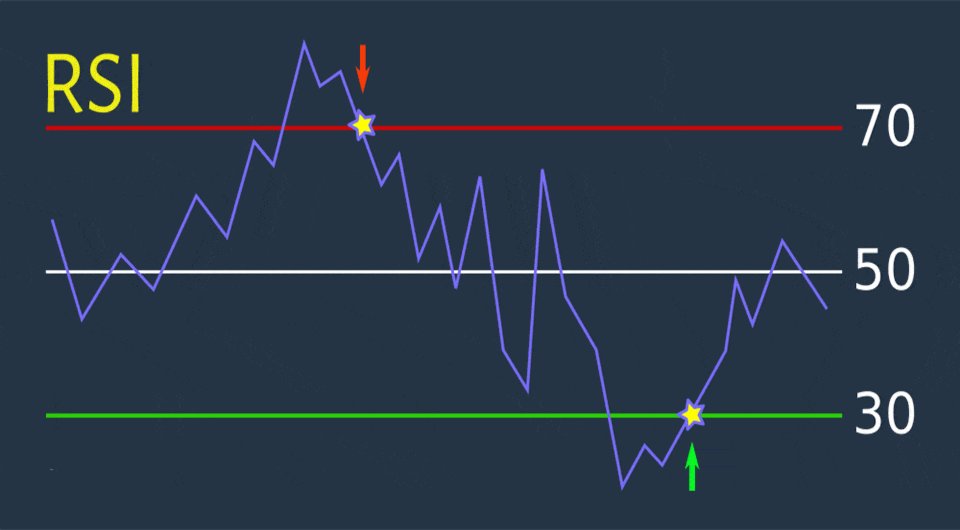

Entry Rules:

- Buy Signal: When RSI crosses above the oversold threshold (default: 30)

- Sell Signal: When RSI crosses below the overbought threshold (default: 70)

-

Exit Strategy:

- Close Buy Position: When RSI crosses into the overbought zone

- Close Sell Position: When RSI crosses into the oversold zone

-

Risk Management:

- Multiple SL/TP calculation methods: Fixed Points, ATR-Based, or Percentage-Based

- Advanced trailing stop with customizable activation triggers and distance

- Pre-trade margin verification

- Proper handling of broker-specific requirements

- Multi-symbol risk distribution

EA Parameters

Symbol Settings

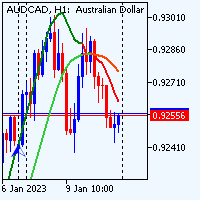

- Multi-Symbol Mode: Option to trade multiple instruments simultaneously

- Symbol List: Define symbols to trade separated by semicolons (e.g., "EURUSD;USDJPY;GBPUSD")

RSI Settings

- RSI Period: Controls the lookback period for the indicator (default: 14)

- Applied Price: Select which price point to use in the calculation (Close, Open, High, Low, etc.)

- Overbought Level: Upper threshold for RSI (default: 70)

- Oversold Level: Lower threshold for RSI (default: 30)

Stop Loss & Take Profit Settings

-

SL/TP Method: Choose between Fixed Points, ATR-Based, or Percentage-Based calculations

-

Fixed Take Profit: Target profit in points (when using Fixed Points method)

-

Fixed Stop Loss: Maximum acceptable loss in points (when using Fixed Points method)

-

ATR Period: Define lookback period for volatility calculation (default: 14)

-

ATR SL Multiplier: Set risk relative to market volatility (default: 1.5)

-

ATR TP Multiplier: Set profit targets relative to volatility (default: 2.5)

-

TP Percentage: Take profit as percentage of entry price (when using Percentage method)

-

SL Percentage: Stop loss as percentage of entry price (when using Percentage method)

Trailing Stop Settings

-

Use Trailing Stop: Enable or disable the trailing stop feature

-

Trailing Stop Method: Choose between Fixed Points, ATR-Based, or Percentage-Based calculations

-

TS Points Trigger: Minimum profit in points before trailing activates (Fixed Points method)

-

TS Points Distance: Distance in points to maintain between price and stop (Fixed Points method)

-

TS ATR Trigger: ATR multiplier for profit before trailing activates (ATR-Based method)

-

TS ATR Distance: ATR multiplier for distance between price and stop (ATR-Based method)

-

TS Percent Trigger: Profit percentage required before trailing activates (Percentage method)

-

TS Percent Distance: Percentage distance to maintain between price and stop (Percentage method)

Trade Parameters

- Lot Size: Fixed volume for each position

- Exit on Opposite Signal: Option to close positions when opposite signal appears

EA Identification

- EA Comment: Custom comment for trade identification

- Magic Number: Unique identifier for the EA's trades

Version History

- V1.0: Initial release with core RSI strategy

- V1.2: Added ATR-based dynamic Stop Loss/Take Profit and Multi-Symbol Trading capabilities

- V1.41: Added flexible SL/TP toggle, exit on opposite signal option, and automatic broker compatibility

- V1.42: Added advanced trailing stop system with multiple calculation methods and customizable parameters

Past performance is not indicative of future results. Please test thoroughly on a demo account before live trading.

O usuário não deixou nenhum comentário para sua avaliação