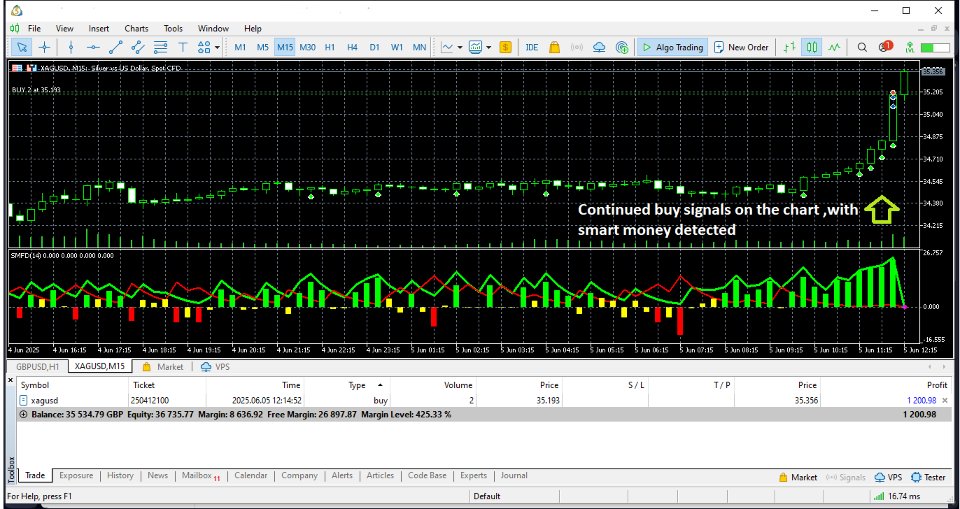

Smart Market Flow Detector

- 指标

- Victor Paul Hamilton

- 版本: 1.31

- 激活: 8

4 Advanced Algorithms Combined Into One Powerful Indicator

The Smart Market Flow Detector (SMFD) is a professional-grade Meta Trader 5 indicator that integrates four distinct analytical algorithms into a single comprehensive tool. By combining Volume Weighted Average Price (VWAP) deviation analysis, hidden flow detection, order flow imbalance calculations, and volume absorption detection, SMFD provides multi-dimensional insights into institutional order flow patterns in currency markets.

Four Integrated Algorithms Working in Harmony

SMFD combines four distinct analytical engines into a single powerful indicator, each contributing unique insights that are synthesized into actionable signals:

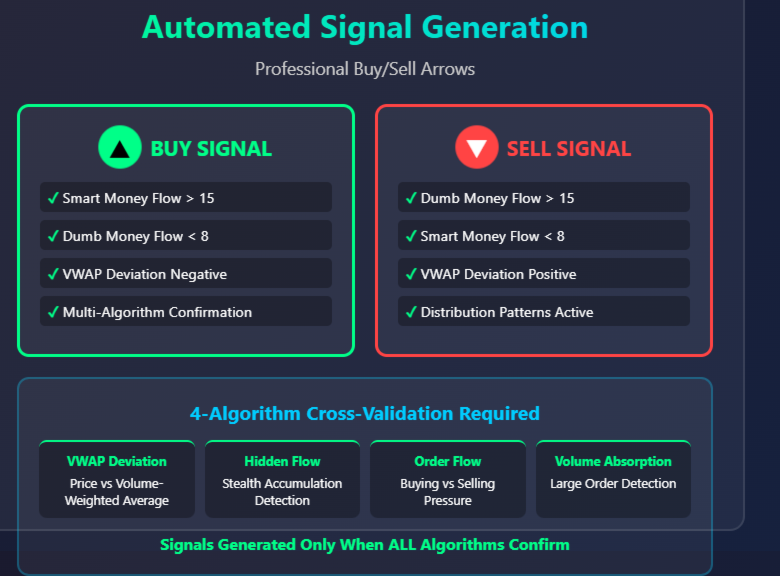

1. VWAP Deviation Analysis

Calculates Volume Weighted Average Price over a configurable period and measures current price deviation as a percentage. Statistical research shows that price tends to revert to VWAP, making deviations significant for identifying potential institutional entry points.

Formula: Deviation = (Current Price - VWAP) / VWAP × 100

2. Hidden Flow Detection

Analyses the relationship between volume spikes and price range compression. When volume exceeds threshold parameters while price range contracts relative to historical averages, this indicates potential absorption activity.

Key Metrics:

- Close position within daily range

- Volume ratio vs. moving average

- Price range compression analysis

3. Order Flow Imbalance Calculation

Estimates buying vs. selling pressure by analysing close position within the high-low range, weighted by volume. Enhanced with tick volume momentum analysis to identify divergences between price movement and volume patterns.

Calculation: Imbalance = (Buying Pressure - Selling Pressure) / Total Pressure × 100

4. Volume Absorption Detection

Identifies periods where volume exceeds 150% of the moving average while price movement remains below 50% of historical average movement. This pattern typically precedes significant price movements.

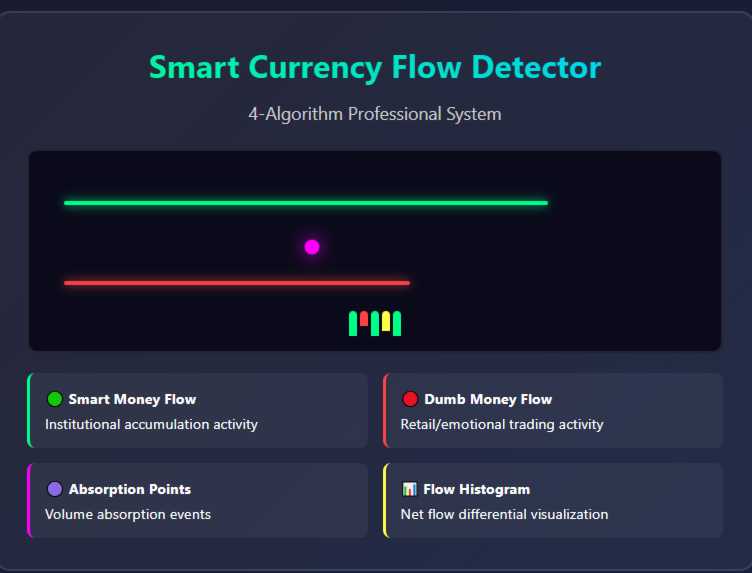

Algorithmic Synthesis

The power of SMFD lies not in any single algorithm, but in how these four analytical engines work together:

- Algorithm Cross-Validation: Signals are only generated when multiple algorithms confirm the same market condition

- Weighted Scoring System: Each algorithm contributes to a composite score that determines final signal strength

- Divergence Detection: When algorithms disagree, it often signals market transition points

- Noise Reduction: Four-algorithm confirmation significantly reduces false signals compared to single-method indicators

Technical Features

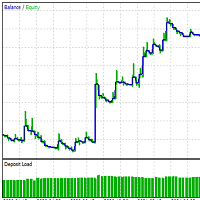

Non-Repainting Architecture

All calculations are performed on completed bars only (pos > 0 validation), ensuring signal reliability and preventing look-ahead bias. This professional implementation guarantees that historical back-testing results accurately reflect live trading performance.

Multi-Buffer Output System

- Smart Flow Buffer: Quantified institutional flow strength

- Retail Flow Buffer: Counter-institutional activity measurement

- Flow Signal Histogram: Net flow differential with colour coding

- Absorption Markers: Volume absorption event identification

Automated Chart Signal System

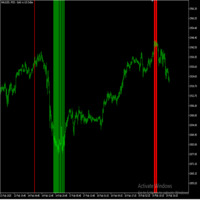

Precision Buy/Sell Arrows

SMFD automatically places buy and sell arrows directly on your price chart when specific algorithmic conditions are met:

Buy Signal Criteria:

- Smart Money Flow > 15 (strong institutional accumulation detected)

- Retail Money Flow < 8 (minimal retail participation)

- Multi-algorithm confirmation across all 4 analytical engines

Sell Signal Criteria:

- Retail Money Flow > 15 (excessive retail participation/chasing)

- Smart Money Flow < 8 (institutional distribution detected)

- Cross-algorithm validation for signal reliability

Signal Features:

- Exact Positioning: Arrows placed at optimal entry levels relative to price action

- Detailed Tooltips: Hover over arrows to see exact flow scores and algorithm readings

- Smart Chart Management: Automatic clean up prevents visual clutter (manages 200+ arrow limit)

- Non-Repainting Guarantee: Signals only appear after bar completion - what you see in back-testing is what you get in live trading

- Color-Coded Clarity: Green arrows (buy) positioned below price, red arrows (sell) positioned above price

Integrated Alert Framework

Real-time notifications with built-in spam protection (5-minute cooldown) to prevent alert fatigue while maintaining responsiveness to significant market events.

Configuration Parameters

Analysis Period (Default: 14)

Defines the lookback period for VWAP calculations and flow analysis. Shorter periods increase sensitivity to recent price action, while longer periods provide more stable trend identification.

Volume Analysis Period (Default: 20)

Sets the moving average period for volume normalization. Used to identify volume spikes relative to historical volume patterns.

Volume Threshold Multiplier (Default: 1.5)

Minimum volume spike ratio required to trigger absorption detection. Higher values reduce false positives but may miss subtle institutional activity.

Display Options

- Absorption point visualization toggle

- Chart arrow annotation control

- Alert system enable/disable

- Custom colour schemes for flow lines

Multi-Timeframe Strategy Applications

Scalping (M1-M5 Timeframes)

Strategy: Use rapid order flow imbalance signals for quick 5-15 pip moves

- Setup: Wait for absorption arrows + immediate buy/sell signal confirmation

- Entry: Enter on signal arrow with tight 3-5 pip stops

- Target: Quick 1:1 or 1:2 risk/reward ratios

- Best Sessions: London/New York overlap for maximum volume flow

Day Trading (M15-H1 Timeframes)

Strategy: Capture intraday momentum shifts and VWAP deviations

- Setup: Combine signal arrows with VWAP deviation extremes (>2% deviation)

- Entry: Signal confirmation at key support/resistance levels

- Management: Trail stops using flow histogram colour changes

- Best Pairs: Major USD pairs during high-volume sessions

Swing Trading (H4-D1 Timeframes)

Strategy: Multi-day position holding using institutional accumulation patterns

- Setup: Wait for absorption clusters + signal arrow confirmation

- Entry: Enter on pullbacks to VWAP after initial signal

- Target: 50-200 pip moves over 2-7 days

- Confirmation: Use higher timeframe flow alignment

Position Trading (Daily-Weekly Timeframes)

Strategy: Long-term trend identification using smart money accumulation

- Setup: Monthly/weekly absorption patterns + consistent flow direction

- Entry: Scale into positions during accumulation phases

- Management: Hold until flow reversal signals appear

- Portfolio: Suitable for portfolio managers and fund strategies

Multi-Timeframe Confluence

Professional Approach: Stack multiple timeframes for highest probability setups

- Higher TF: Identify trend direction (D1/W1)

- Entry TF: Time precise entries (H1/H4)

- Confirmation TF: Validate momentum (M15/M30)

- Risk Management: Exit when any timeframe shows flow reversal

Statistical Foundation & Multi-Algorithm Advantage

The indicator's four-algorithm approach is based on empirical market microstructure research:

- VWAP Mean Reversion: Statistical tendency for price to revert to volume-weighted average over time

- Volume-Price Relationships: Correlation analysis between volume spikes and subsequent price movements

- Order Flow Theory: Academic research on buying/selling pressure estimation through intrabar analysis

- Absorption Patterns: Quantitative identification of large order execution through volume/range analysis

Multi-Algorithm Statistical Edge: By requiring confirmation across multiple analytical methods, SCFD achieves significantly higher signal reliability than single-algorithm indicators. Research shows that multi-factor models reduce false positive rates by up to 60% while maintaining signal sensitivity.

Installation & Implementation

System Requirements

- Meta Trader 5 build 2515 or higher

- Minimum 4GB RAM recommended for optimal performance

- Compatible with all MT5 brokers and account types

Setup Process

- Place SMFD.mq5 file in /MQL5/Indicators/ directory

- Restart Meta Trader 5 platform

- Attach indicator to chart via Navigator panel

- Configure parameters according to trading strategy

- Enable alerts if desired for real-time notifications

Performance Notes: Optimized for minimal CPU usage. Suitable for multiple chart deployment without system impact.

Package Contents

- SMFD.mq5 - Complete indicator source code with full algorithm implementation

- Technical Documentation - Detailed explanation of calculation methods and parameters

- Implementation Guide - Step-by-step configuration instructions

- Parameter Optimization Guide - Timeframe-specific recommended settings

- Update Access - All future algorithm improvements and bug fixes included

- Technical Support - Direct developer contact for implementation assistance

Technical Specifications

- Signal Generation: Automated buy/sell arrows with algorithmic validation

- Signal Reliability: Zero repainting through completed bar analysis only

- Chart Integration: Direct price chart annotation with smart clean up system

- Timeframe Compatibility: M1 through MN1 with automatic parameter scaling for all strategies

- Resource Efficiency: Optimized algorithms with minimal CPU overhead

- Instrument Support: All Meta Trader 5 supported symbols including forex, indices, commodities

- Data Requirements: Minimum 50 bars for accurate calculations

- Memory Usage: Efficient buffer management prevents memory leaks

- Signal Frequency: Adaptive - more signals on lower timeframes, selective on higher timeframes .

User Feedback

"The non-repainting architecture is essential ."

"Volume absorption detection has improved my entry timing significantly. The algorithm correctly identifies institutional activity patterns."

"Clean implementation with efficient resource usage. Suitable for algorithmic trading system integration."

Feel free to contact me before or after your purchase if you have any questions regarding the Smart Market Flow Detector, or to request your PDF manual. Thank you."