Real Time Spread Display Tool

- Utilities

- Yue Wen Wang

- Version: 1.0

- Activations: 5

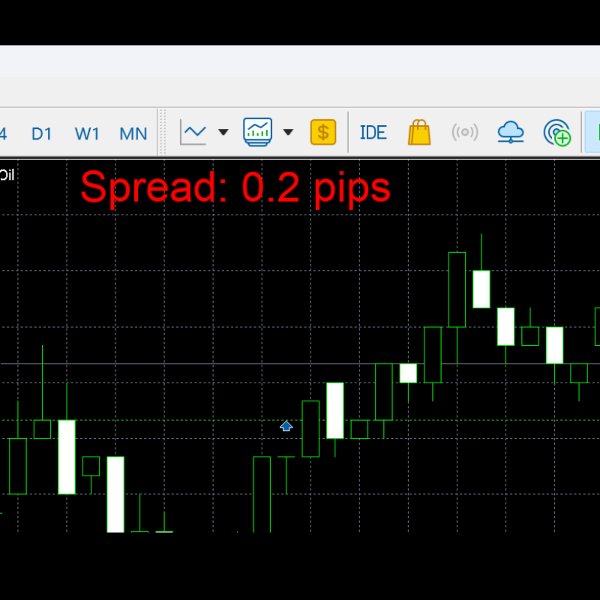

Real-Time Spread Display Tool

A real-time spread display tool is a specialized software or application designed to provide traders and investors with instant, live data on the spread—the difference between the bid price (the price at which buyers are willing to purchase an asset) and the ask price (the price at which sellers are willing to sell it)—for various financial instruments. This tool is critical in markets such as forex (FX), stocks, futures, and cryptocurrencies, where price fluctuations and liquidity impact trading decisions.

Use Cases

- Trading Strategy Development: Traders use spread data to identify assets with favorable liquidity (narrow spreads) for efficient entry/exit or to avoid illiquid assets with high transaction costs (wide spreads).

- Risk Management: Widening spreads during volatile market conditions (e.g., economic news releases, geopolitical events) signal increased risk, prompting traders to adjust position sizes or exit trades.

- Broker Comparison: Investors can use the tool to compare spreads offered by different brokers for the same asset, ensuring competitive pricing.

- Arbitrage Opportunities: Traders looking to exploit price differences across exchanges can monitor spreads in real time to identify arbitrage setups.

Why It Matters

Spreads directly impact trading profitability, as they represent the implicit cost of each trade. A real-time spread display tool empowers users to:

- Make informed decisions based on live market liquidity.

- Minimize costs by trading during periods of narrow spreads.

- Adapt to market dynamics quickly, especially in fast-paced environments.

For both retail and institutional traders, this tool is a cornerstone of efficient trading, bridging the gap between market data and strategic execution.