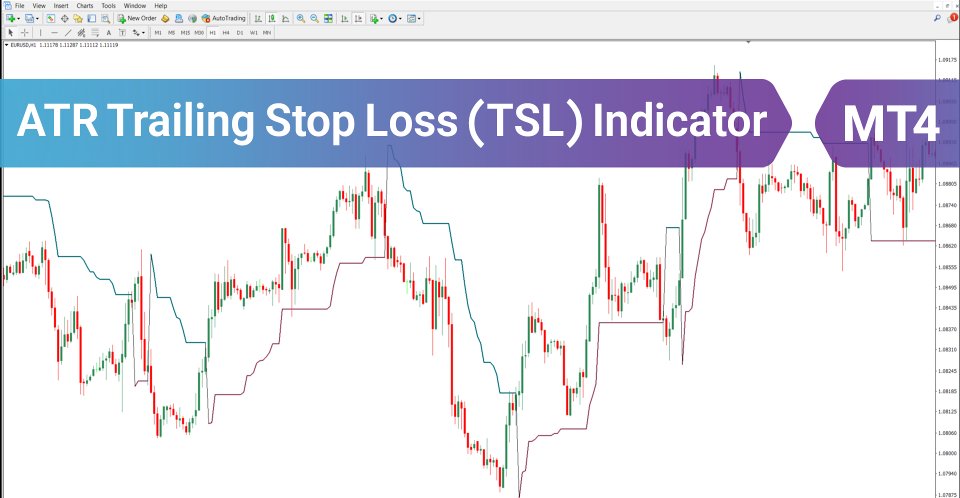

ATR Trailing Stop TSL Indicator MT4

ATR Trailing Stop TSL Indicator MT4

The ATR Trailing Stop Indicator (ATR TSL) is a practical solution for risk management in MetaTrader 4. It generates a dynamic stop-loss level based on the market’s Average True Range (ATR), automatically adapting to price volatility.

As market conditions shift, the ATR Trailing Stop continuously adjusts stop-loss levels in the direction of the trade. In an uptrend, the stop-loss is displayed in green, while in a downtrend, it is shown in red, visually distinguishing the trade direction and risk management zones.

«Indicator Installation & User Guide»

MT4 Indicator Installation | ATR Trailing Stop TSL Indicator MT5 | ALL Products By TradingFinderLab | Best MT4 Indicator: Refined Order Block Indicator for MT4 | Best MT4 Utility: Trade Assistant Expert TF MT4 | TP & SL Tool: Risk Reward Ratio Calculator RRR MT4 | Prop Firm Protector: Trade Assist Prop Firm Plus TF Expert MT4 | Money Management + DrawDown Protector: Trade Panel Prop Firm Drawdawn Limiter Pro MT4

Indicator Specifications Table

| Category | Price Action - High Volatility - Trading Tools |

| Platform | MetaTrader 4 |

| Skill Level | Beginner |

| Indicator Type | Reversal |

| Time Frame | Multi timeframe |

| Trading Style | Swing Trading |

| Market | All Markets |

Indicator at a Glance

The ATR Trailing Stop Indicator uses the Average True Range to determine price volatility and plots stop-loss levels at essential turning points in the market. When combined with other technical tools, this indicator provides traders with optimized stop-loss placement, enhancing their overall market analysis and risk management.

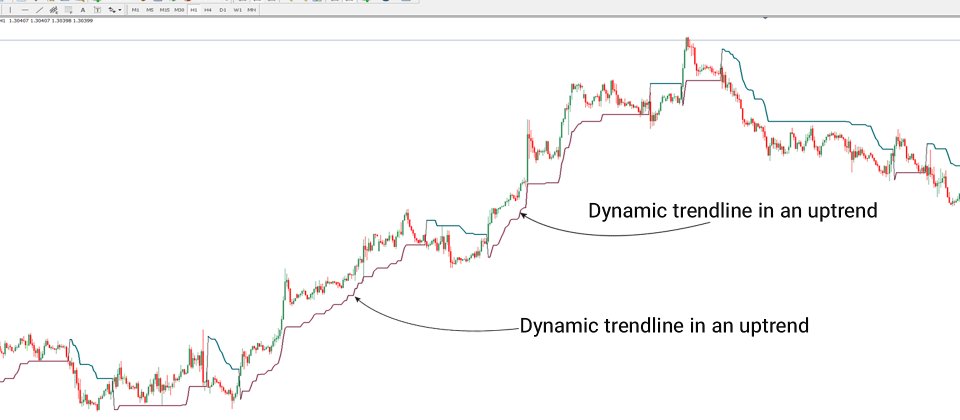

Uptrend Conditions

The 1-hour chart of the GBP/USD currency pair highlights the indicator’s performance in an uptrend scenario. As the price increases, the ATR value also tends to rise, resulting in a narrower distance between the stop-loss level and the current price.

Additionally, the Trailing Stop Loss (TSL) dynamically moves upward with the market, offering traders adaptive protection while maintaining proximity to the price movement.

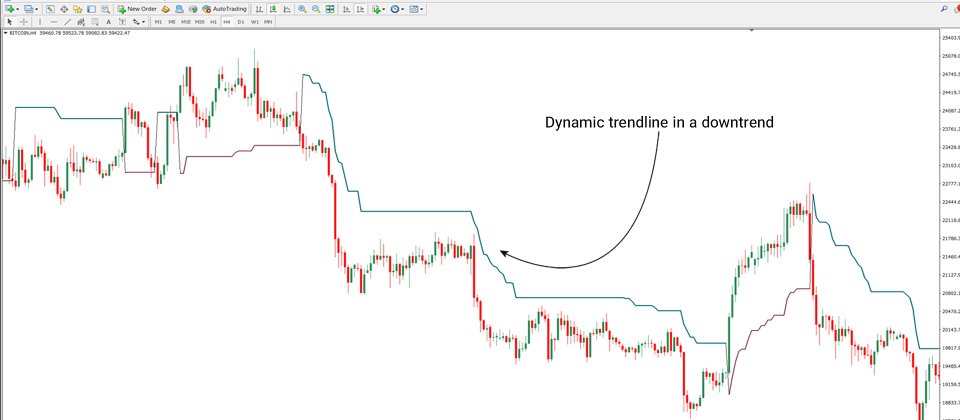

Downtrend Conditions

The 4-hour chart of Bitcoin (BTC) illustrates the indicator’s behavior during a downtrend.

As the price declines, the ATR typically decreases as well, which shortens the distance between the stop-loss level and the price. Simultaneously, the Trailing Stop Loss (TSL) tracks the price movement downward, adjusting in real time to help protect open positions in volatile or trending markets.

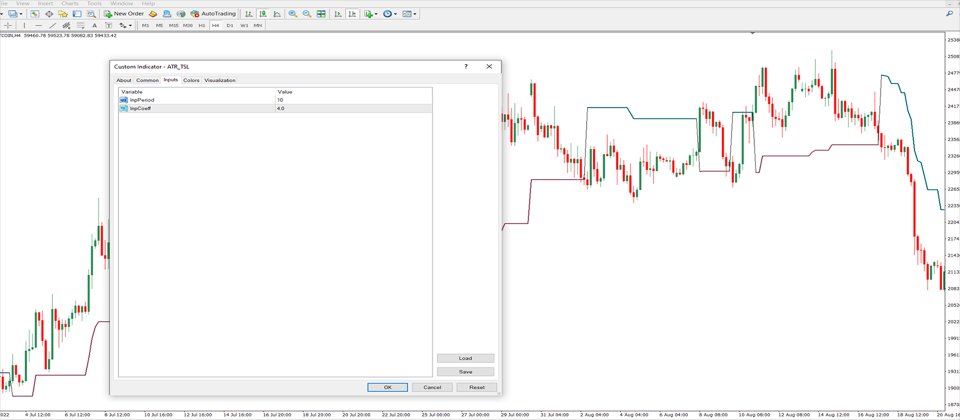

Settings

· Inp Period: ATR calculation period set to 10

· Inp Coeff: Coefficient multiplier set to 4.0

Conclusion

With its dynamic stop-loss adjustment capabilities, the ATR Trailing Stop Indicator in MetaTrader 4 enhances trade management and increases responsiveness to sudden market movements. A proper understanding of how this indicator operates can significantly contribute to improved trading performance, better capital protection, and greater confidence in managing positions.